Financial Calculator

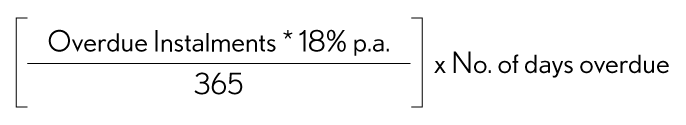

In order to calculate how much you’ll need to set aside for your new Lexus, simply choose your model and use the financial calculator to work it all out before you proceed to get your finances approved online.

CALCULATE YOUR FINANCES