ELEGANT.

STREAMLINED, FAST.

eGIRO. A simple, hassle-free solution

for your Lexus payment plan.

ABOUT US

At Lexus Financial Services (LFS), our aim is to provide the products and services that ultimately enable people to enjoy the freedom of movement. By offering Financial and Mobility Services, we work hard to build a unique bond with people and be a truly valuable partner throughout their driving life.

We believe that our integrity, clarity and passion to innovate will lead us in our decision making and allow us to enjoy our journey along with our customers.

Lexus Comfort

Lexus Comfort is a standard hire purchase, which is a simple, easy way to put you behind the wheel of your dream car.

FIND OUT MOREFinancial Calculator

In order to calculate how much you’ll need to set aside for your new Lexus, simply choose your model and use the financial calculator to work it all out before you proceed to get your finances approved online.

CALCULATE YOUR FINANCES

FAQs

- How much can be borrowed?The loan is up to a maximum loan quantum of 70% of the purchase price if the Open Market Value (OMV) of the vehicle is up to $20,000, or 60% of the purchase price if the OMV of the vehicle is above $20,000.

- What is the maximum loan tenure?The maximum loan tenure is up to 7 years.

- What are the eligibility criteria to apply for a Hire Purchase Loan?Singaporeans, Singapore Permanent Residents and foreigners aged 21 and above with a minimum monthly income of S$2,000 are eligible to apply for a loan.

There may be instances where individuals (i.e. Housewives and Retirees) with no income and guarantor can be granted financing. This will be assessed on a case-by-case basis subject to their finance terms as well as their credit standing. - How is the interest on the loan computed?The interest is computed on a flat rate basis, calculated upfront as a lump sum based on the flat rate of interest and added to the loan amount to derive the monthly instalment.

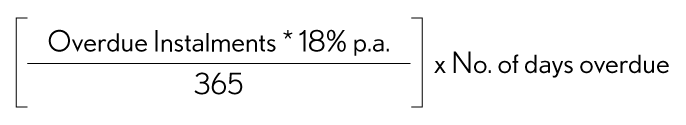

- What will happen if a loan repayment is missed?Apart from a late payment penalty of S$60, the overdue instalment amount (made up of the principal and interest) will also be subject to interest accruing at a daily flat rate of18% per annum, computed using the formula below:

- How is the interest rebate on the remaining loan period calculated?The interest rebate is calculated using the Rule of 78 methodology expressed by:

n (n+1)/N (N+1) x TC, where

“n” represents the unexpired period of hire in terms of months

“N” represents the original period of hire in terms of months

“TC” represents the total amount of interest for the contract - What is the early termination penalty?The early termination penalty consists of a rebate deductible amount equal to 20% of the interest rebate, as well as an early settlement fee of 1% (For new passenger cars) or 2% (For all other segments) of the financed amount.

- Do you accept partial settlement?No, only full settlement of the loan is allowed.

- How can the loan be redeemed?Please contact us at 69782388 or cs@tfssg.sg to obtain a full settlement quotation.

The loan can be redeemed through the following payment methods:- Internet Banking:

Account name: Lexus Financial Services Singapore Pte. Ltd.

Bank Name: DBS Bank Ltd

Bank Account No.: 072-019772-0 - PayNow through our corporate UEN No: 202000205M

- Cashier’s order made payable to “Lexus Financial Services Singapore Pte Ltd” with the vehicle number indicated at the back

- Internet Banking:

- What is the application channel for a Hire Purchase Loan or Leasing?For retail individuals, the loan may be applied digitally through the notification URL triggered by your Borneo Motors salesperson over SMS and Email.

Please prepare the following documents to facilitate the application (only if not applying through MyInfo)- NRIC front and back copies

- Latest income documents

Please prepare the following documents to facilitate the application:- Bizfile from ACRA

- The Company’s bank statements for the previous 3 months, or the latest financial report

- Front and back copies of the guarantor’s NRIC

- The latest income documents of the guarantor, preferably the latest NOA or 3 months of computerized pay slips

- How can I check the status of my loan application?You may check the status of your loan application with your Borneo Motors salesperson. An email notification will also be sent to you upon loan approval.

- How long will it take for my loan application to be approved?An application submitted via MyInfo may be approved instantly, subject to satisfactory credit checks, at any time of the day. For manual entry or hard copy submission, we strive to come back with the status on the same working day (cut-off time at 5pm). Please expect delays for any application with incomplete information or documentation.

- What is my loan account number and due date?Your loan account details will be stated on the welcome letter mailed to you upon your loan disbursement.

- How can I find out more about the account details?You may contact us at 69782388 or cs@tfssg.sg to find out more about the account details.

- What are the modes of payment available to pay my monthly instalments?There are several convenient ways to pay the instalments:

- Preferred option: eGIRO – takes only 2-3 minutes to approve. Click here to apply.

- Bank Transfer via Internet or Mobile Banking

Account name: Lexus Financial Services Singapore Pte. Ltd.

Bank Name: DBS Bank Ltd

Bank Account No.: 072-019772-0 - PayNow through our corporate UEN: 202000205M

- Who can use eGIRO?Both individuals and businesses (commercial companies) can apply for eGIRO, provided they have accounts with participating banks.

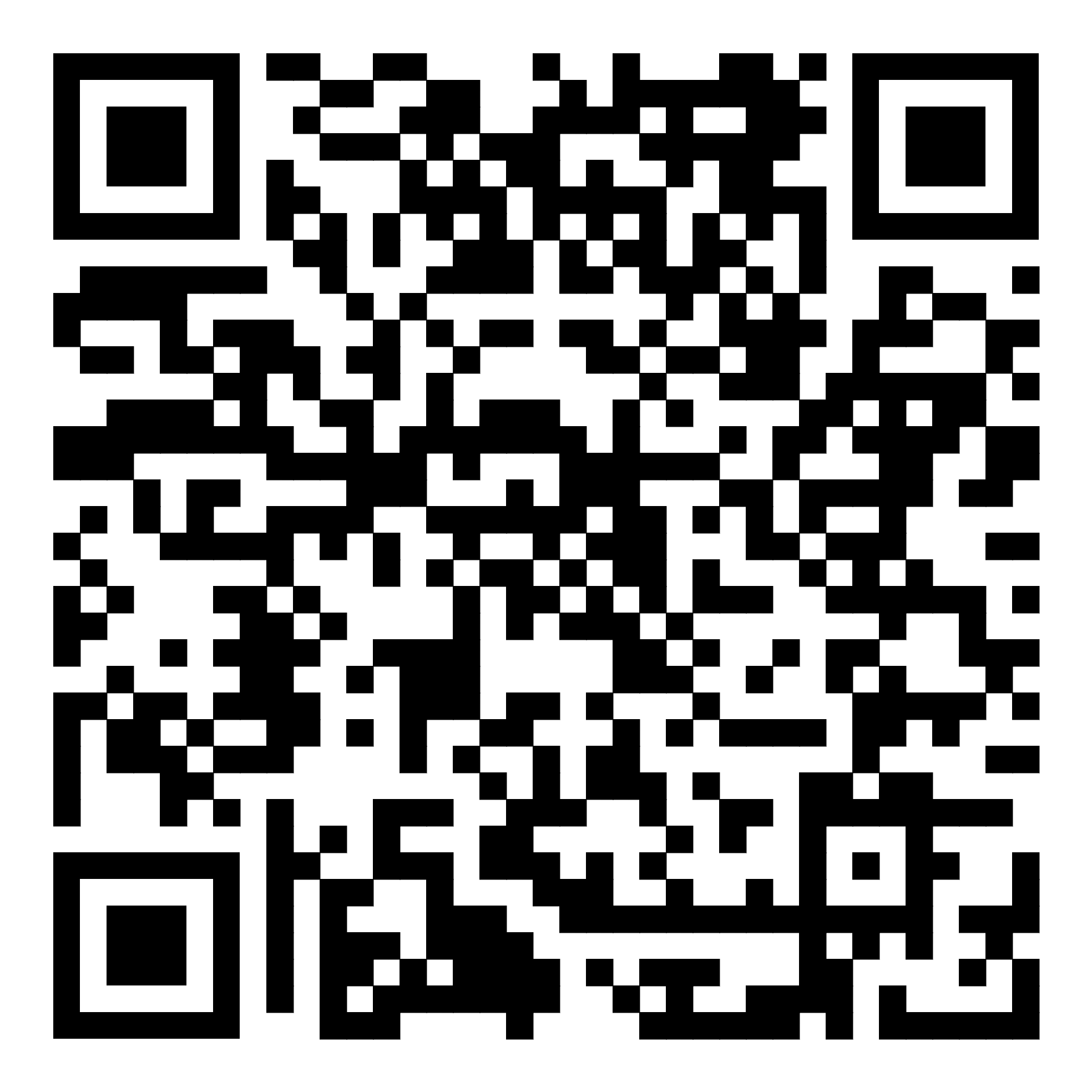

- How to apply for GIRO?Individuals and businesses can submit your e-GIRO application here or scan the QR code provided.

For more detailed information on what is eGIRO, please click here - Will eGIRO replace the current paper GIRO?eGIRO will replace the paper-based version of GIRO application form. eGIRO takes 2-3 minutes to approve, compared to a paper-based application form that takes 4-6 weeks.

- Is eGIRO safe?Yes, we put in place stringent security measures to ensure that your data is protected.